As you may know, Olympic Summer Games kick off on August the 5th with the long-awaited opening ceremony in the suggestive Maracana stadium: an historic edition, as Rio will be the very first Olympic host city in South America, just two years after FIFA World Cup being held there.

The Games’ economic sustainability is a much-debated topic, given the difficulties faced by many cities in managing the post-event legacy: two case histories which are always taken into discussion are Montreal 1976 and Athens 2004, editions that had haddevastating financial ramifications on Canada and Greece respectively.

Speaking about financing the Games: what are their revenue streams? How much does each of them contribute and how does the IOC distribute the money to each Committee and Federation?

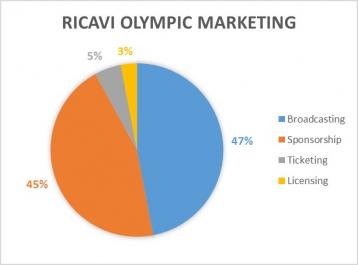

Taking a look at data provided by the IOC, the first thing that comes up is a growth trend in the business volume: comparing revenues from 1993 to 1996 with the ones of 2013-2016, the value has indeed more than tripled, going from 2.6 to 8.2 USD billions. While ticketing and licensing impacts haven’t changed significantly (except for London 2012, where ticketing revenues skyrocketed at 988 USD millions), broadcasting and sponsorship deals have established as the most relevant forms to finance the Games.

*value expressed in USD billions

Broadcasting rights form the biggest share of the marketing revenues, accounting for nearly half of the Games’ revenues and more than 70% if we only refer to IOC, because the money coming from domestic sponsorships doesn’t go to IOC.

The NBC is the USA olympic network (it owns rights to broadcast Youth and Paralympic Games too), and it has been paying IOC an average of 1.1 USD billions for the Games between 2014 and 2020. From 2021 to 2032 this amount, will be growing up +14%.

NBC will produce 6,000+ hours of Olympic contents, and it has been announced with an official statement at the end of last March that the network had already reached the 1-billion milestone in ad sales, guaranteeing NBC the possibility to break the record set in London (1.3 billions).

The global audience expected to watch the Games is more than 3.6 billion people, the ones that watched the London Games. Moreover, we have to prepare ourselves to a sounding growth of the Olympic movement on social networks, as examples like the @OlympicFlame Account and the NBC deal with Snapchat, that both suggest us that the strong will is to engage a young and digital audience by telling the athletes’ stories.

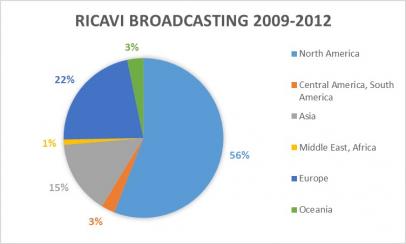

The biggest slice of the broadcasting rights’ cake is the North American one, as the official IOC data tell us (2009-2012 period):

Rio 2016 will obviously see an increase of the South American market share , helping the total broadcasting revenues to jump from 3.8 to 4.1 USD billions.

Talking about sponsorships, first we have to make a distinction between the TOP programme, which comprises the official IOC partners, and domestic sponsorships, companies that support the hosting national Olympic committee, named OGOC (Olympic Games Organizing Committee).

The TOP sponsors are eleven international companies (Samsung, Coca-Cola, General Electric, Bridgestone, P&G, Atos, DOW, Omega, McDonald’s, Visa, Panasonic) that own rights to associate their brands to the Olympic Games during the event and possess exclusivity on their business sector, too. These partners, headlined by the forever-olympic sponsor Coca-Cola (being there since Amsterdam 1928), will welcome Toyota, starting from 2017 which will take TOP revenues over the 1-billion mark. Revenues coming from this program are distributed in this way: 40% to national Olympic committees (NOCs) and international federations (Ifs), 50% to OCOGs, 10% to IOC.

Furthermore, there are four different tiers in domestic partnerships, with different levels of sponsorship rights that divide forty-nine companies into Official Sponsors, Official Supporters, Official Suppliers and Suppliers; these revenues exceed 2.5 USD billions in 2013-2016 period, five times more than it was 20 years ago, and they all end up in the OCOG finances.

Manuel Riccio - Voice2Media